Line Chart: A Beginner’s Guide to Understanding Stock Price Trends

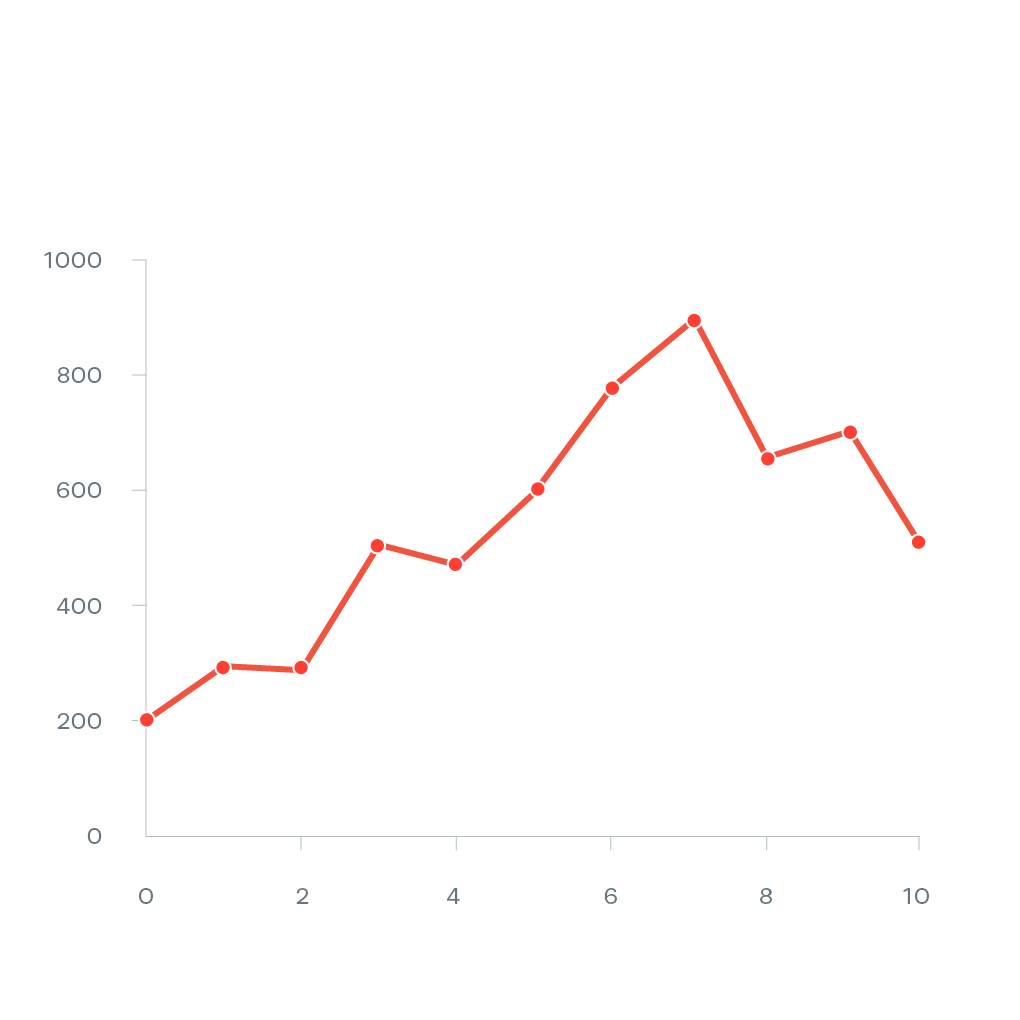

When navigating the stock market, traders and investors often seek a simple, effective way to visualize the performance of a stock over time. One of the most popular methods for doing so is through a line chart. This straightforward chart type can reveal trends, patterns, and insights that help inform buying and selling decisions. Let’s explore what a line chart is, its key benefits, and how you can use it to interpret stock movements with confidence.

What is a Line Chart?

A line chart connects the closing prices of a stock over a set period with a continuous line. This type of chart is particularly popular among beginners because it emphasizes overall trends rather than minor price fluctuations, making it easy to observe general price movement over days, weeks, months, or even years.

| Element | Description |

|---|---|

| Chart Type | Line Chart |

| Data Represented | Closing prices over time |

| Primary Purpose | Visualize general stock price trends and movement |

| Ideal For | Beginners and traders looking for quick trend insights without complex data overlays |

| Key Feature | Simple, continuous line connecting data points, typically on daily closing prices |

How to Read a Line Chart

Understanding a line chart is straightforward. The horizontal axis (x-axis) represents time, while the vertical axis (y-axis) represents stock price. Each data point along the line corresponds to the closing price of a stock at the end of each trading day.

Here’s a breakdown of what to look for:

- Upward Sloping Line: Indicates an uptrend, suggesting the stock’s value is rising over time.

- Downward Sloping Line: Signals a downtrend, indicating the stock’s value is falling.

- Flat Line or Horizontal Pattern: Shows a period of stability or consolidation in the stock price.

Why Use a Line Chart?

- Simplicity and Clarity: Line charts are easy to read, offering a simple and clean look at the stock’s performance over time without visual clutter. For beginners, this is especially helpful as it allows them to focus on broad market trends rather than being overwhelmed by intricate data.

- Trend Identification: The continuous line helps traders see whether a stock is trending upward or downward. Identifying these trends early can be critical for making profitable trading decisions.

- Historical Comparison: By examining historical data, investors can assess whether a stock has been consistent in growth or has experienced significant volatility, helping in longer-term planning.

- Decision-Making Insight: A clear view of the general trend can guide traders on whether to enter or exit a position, especially for those who don’t need the detail of more complex chart types.

Line Chart vs. Other Types of Charts

| Chart Type | Primary Use | Level of Detail | Ideal User |

|---|---|---|---|

| Line Chart | Observe general trends | Low | Beginners |

| Bar Chart | Compare opening, high, low, and close | Moderate | Intermediate users |

| Candlestick | Detail intraday movement | High | Advanced traders |

| Area Chart | Emphasize volume and overall trend | Moderate | General investors |

Line charts stand out due to their minimalism, making them ideal for newcomers. Unlike bar or candlestick charts, which display a wider range of data (including high, low, and open prices), line charts cut to the basics by focusing on the closing price—a crucial indicator for many traders.

Step-by-Step Guide to Creating a Line Chart

- Choose Your Time Frame: Determine the period you want to examine (e.g., daily, weekly, monthly).

- Gather Closing Price Data: For each time point, record the stock’s closing price.

- Plot Your Data Points: Place each closing price along the y-axis and the corresponding time period along the x-axis.

- Draw the Line: Connect each data point with a line to form a continuous path, showing the stock’s trend over the selected period.

Let’s go through an example:

Example: Analyzing the Trend of XYZ Stock

Imagine we’re examining the stock performance of XYZ Corp. over five days. Here’s the sample data:

| Date | Closing Price ($) |

|---|---|

| Day 1 | 100 |

| Day 2 | 105 |

| Day 3 | 102 |

| Day 4 | 107 |

| Day 5 | 110 |

- Plot the Data Points: Each closing price is plotted on the chart corresponding to its respective day.

- Connect the Dots: Draw a line between each point to reveal the trend.

The resulting line chart would show an upward trend for XYZ stock over these five days, suggesting a positive outlook.

Benefits of Using Line Charts for Stock Analysis

- User-Friendly Interface: Ideal for beginners and casual investors, line charts provide essential information without overwhelming details.

- Quick Insight into Trends: Helps investors quickly assess whether a stock is trending up, down, or sideways.

- Visualizing Historical Performance: Line charts enable users to evaluate past performance, which is often an indicator of future behavior.

- Less Noisy: Unlike bar or candlestick charts, which can sometimes overemphasize daily price fluctuations, line charts offer a smooth, clear view of the stock’s general trend.

Limitations of Line Charts

While line charts have many advantages, they’re not without limitations. Here are a few to consider:

- Lack of Intraday Detail: Line charts only show the closing price, leaving out valuable information like daily highs, lows, and open prices.

- Not Ideal for Volatile Stocks: In volatile markets or for stocks with significant price swings, a line chart may oversimplify data, causing investors to miss critical information.

- Limited for Advanced Analysis: Line charts lack indicators and overlays like moving averages or Bollinger Bands, which can be crucial for in-depth technical analysis.

How to Use Line Charts for Decision-Making

To get the most out of a line chart, consider the following tips:

- Identify Support and Resistance Levels: Look for horizontal lines where the stock’s price tends to stall or reverse, as these are potential support (low) and resistance (high) levels.

- Spot Trend Reversals: Notice any sudden changes in the trend direction. For example, a steep incline turning into a flat line may signal the end of an uptrend.

- Use Moving Averages for Confirmation: Even though line charts are simple, pairing them with moving averages can offer added clarity on longer-term trends.

Conclusion

Line charts are an invaluable tool for both new and experienced traders seeking to understand general price movements over time. By focusing on the closing price, line charts offer a clean, intuitive view of a stock’s performance, making them an excellent choice for spotting trends, comparing historical data, and making informed trading decisions. While they may lack the depth of other chart types, line charts remain a solid foundation for those starting their investment journey.

In summary:

| Line Chart Advantages | Line Chart Disadvantages |

|---|---|

| Simple to read | Lacks intraday data |

| Highlights general trends | Not ideal for volatile stocks |

| Easy for beginners | Limited analytical tools for advanced traders |

By embracing the simplicity of line charts, investors can make sense of complex data in an accessible format, giving them a solid grounding in market trends and empowering them to make more confident decisions.

Leave a Reply