Mastering Bar Charts for Trading: The Power of OHLC Analysis

When it comes to analyzing stocks, bar charts provide invaluable insights that can aid traders in making well-informed decisions. Known for their clarity and detail, bar charts reveal essential information about each trading session through the OHLC (Open, High, Low, and Close) prices. In this blog, we’ll dive into the essentials of bar charts, explaining how they work, their benefits, and how you can leverage this tool to spot trends and price movements with accuracy.

What is a Bar Chart in Trading?

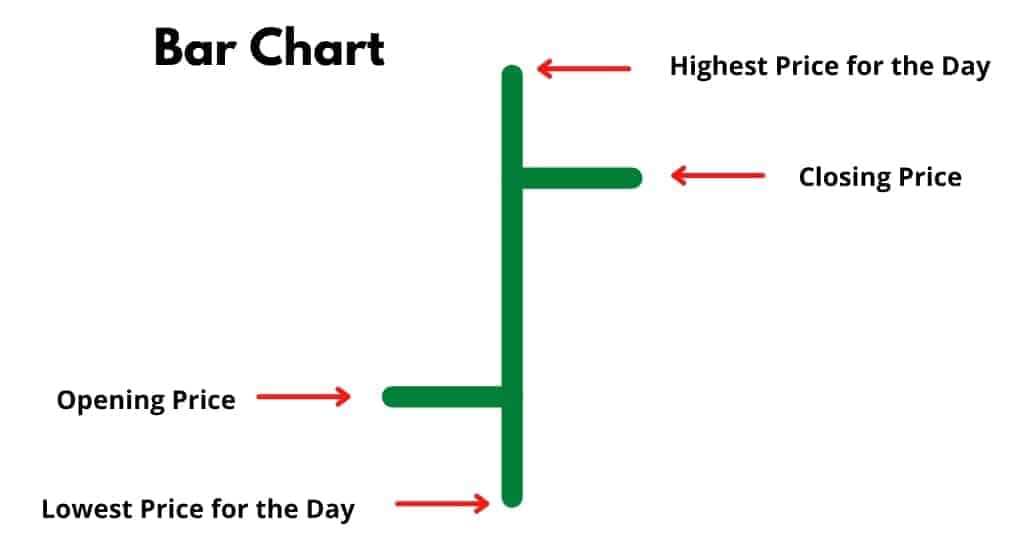

A bar chart is a graphical representation of trading data for a particular asset, where each bar represents a single trading session (such as a day, week, or hour, depending on the chart’s timeframe). These bars display the OHLC data points:

- Opening Price (O): The price at which the asset opened at the start of the trading session.

- High Price (H): The highest price reached during the session.

- Low Price (L): The lowest price recorded.

- Closing Price (C): The price at which the session ended.

This information is visually presented with each bar consisting of a vertical line (indicating the high and low prices) and horizontal tick marks on either side (representing the opening and closing prices).

Structure of a Bar Chart: Breaking Down the OHLC

Each trading day is illustrated by a single vertical bar. Here’s a breakdown of the components of a standard bar chart:

| Component | Description |

|---|---|

| Opening Price | Left tick on the bar; shows the start of the day’s trading. |

| Closing Price | Right tick on the bar; shows the end of the day’s trading. |

| High Price | Top of the vertical line; shows the highest price reached. |

| Low Price | Bottom of the vertical line; shows the lowest price reached. |

These four elements enable traders to see not only where the price started and ended but also the entire range it covered during the trading day. Let’s explore why these specific data points are so essential.

Why Use Bar Charts?

Bar charts are valuable because they provide a clear picture of price movement within a session, helping traders understand the day’s price range and general direction. The OHLC data is critical for many reasons:

- Identify Price Range: The high and low prices show the extent of price fluctuations, providing insight into volatility and the strength of price movement.

- Determine Market Sentiment: The relationship between opening and closing prices helps gauge market sentiment. For instance, a close higher than the open suggests bullish sentiment, while a close lower than the open may indicate bearish sentiment.

- Spot Price Trends: By looking at sequences of bars, traders can spot price trends, such as a series of higher highs and higher lows signaling an uptrend.

- Pinpoint Reversal Signals: Bars that show strong reversals from highs or lows can signal potential shifts in market direction.

Using OHLC Data to Interpret Market Movements

To harness the power of OHLC bar charts, it’s important to recognize specific patterns and what they can signify about the market’s condition.

- Bullish Bars: If the close is higher than the open, the bar is often considered bullish. This pattern shows that buyers controlled the market by pushing prices up over the trading session.

- Bearish Bars: Conversely, if the close is lower than the open, the bar is bearish, indicating sellers dominated by pushing prices down.

- Indecisive Bars (Doji): Bars where the open and close are very close to each other suggest indecision. This pattern, known as a “Doji,” often signals that buyers and sellers were evenly matched.

Benefits of Using Bar Charts in Trading

- Comprehensive View of Price Action: Bar charts offer more detailed insights compared to simple line charts, as they include the entire range of price movement.

- Simplicity in Spotting Trends: Trends are easy to spot with bar charts, as traders can identify sequences of higher or lower highs and lows.

- Identification of Reversals: Certain bar patterns can indicate potential reversals, such as bars with long wicks on one end, suggesting a rejection of a price level.

- Enhanced Volume Analysis: Many traders combine bar charts with volume data to see if price movements are supported by trading activity, which adds confidence to trade decisions.

Key Patterns to Watch in Bar Charts

Here are a few key patterns that can provide insights into price movement:

| Pattern | Description | Trading Insight |

|---|---|---|

| Bullish Engulfing | A larger bullish bar that engulfs the previous bearish bar. | Indicates a potential reversal to the upside. |

| Bearish Engulfing | A bearish bar that engulfs the previous bullish bar. | Signals a possible downside reversal. |

| Inside Bar | A bar with a high and low within the previous bar’s range. | Suggests consolidation, often preceding a breakout. |

| Outside Bar | A bar that covers a larger range than the previous bar. | Indicates volatility and potential trend reversal. |

Example of Reading a Bar Chart

Consider a stock with the following OHLC values over five trading sessions:

| Day | Open | High | Low | Close |

|---|---|---|---|---|

| Monday | 50 | 55 | 48 | 52 |

| Tuesday | 52 | 58 | 51 | 54 |

| Wednesday | 54 | 60 | 53 | 59 |

| Thursday | 59 | 61 | 57 | 58 |

| Friday | 58 | 62 | 56 | 60 |

- Monday: The price opened at 50, reached a high of 55, a low of 48, and closed at 52. This session is bullish because the close is higher than the open.

- Thursday: The bar suggests some selling pressure as the close is lower than the high, possibly indicating resistance around the 61 level.

By studying this data in a bar chart, you can visualize the price movement trends and gain insights into where resistance and support levels might lie.

Tips for Using Bar Charts Effectively

- Combine with Other Indicators: Use bar charts alongside moving averages, volume, or momentum indicators to enhance decision-making.

- Understand Price Action Fundamentals: Familiarize yourself with basic price action patterns, such as pin bars and engulfing bars, to spot potential trading setups.

- Use Multiple Time Frames: For a more detailed view, analyze bar charts across multiple time frames (daily, weekly, and monthly) to get a clearer sense of the trend and potential reversal points.

- Practice Patience: While bar charts are useful, they’re not infallible. It’s essential to practice patience and wait for confirmation before entering a trade based on a single bar pattern.

Conclusion: Why Bar Charts are a Staple in Trading Analysis

Bar charts offer a balanced view of price action, detailing not just where a stock started and ended but the entire journey within a trading session. By honing your skills in reading OHLC bar charts, you can improve your ability to assess market sentiment, identify key price levels, and spot trend changes effectively.

Final Thoughts: Make Bar Charts Work for Your Strategy

As with any trading tool, practice is key to mastering bar charts. Study historical charts, observe how different bar patterns lead to price movements, and incorporate this technique into your trading plan. With time, bar charts will become a powerful tool in your trading arsenal, helping you navigate the markets with greater precision and insight.

By understanding the OHLC values and their significance, you’ll be well-equipped to make strategic decisions based on a comprehensive view of each trading session’s price action.

Leave a Reply